The 'flight to safety' buying seemes to have ended, and as market players back away from US Treasuries, seeking better returns from 'risky assets' - emerging market equities and foreign currencies; the USD has witnessed a selloff.

While a strong USD was affecting the profitability of large US MNCs, the current USD weakness has also resulted in a rally in commodities : read - Crude Oil, Precious Metals, Copper, Aluminium etc.

.

Despite worrying economic issues in certain EU nations, the Euro is well off its recent lows. Challenging times lie ahead as countries like Portugal, Ireland, Spain, Italy and Greece face rising unemployment issues and GDP growth problems. With a policy mandate that is quite different from the US Fed, the ECB is going to have to walk a tightrope by helping out weaker EU members, without annoying the larger and relatively 'economically stable' countries.

Unstable + collapsing economies in eastern europe are also a major worry!

.

The Pound Sterling had a horrid 2008, struggling against most currencies. While interest rate cuts may have helped so far, the UK is faced with record consumer debt levels, a weak housing market, and unemployment problems - just like its larger ally the USA. As the slowdown batters the financial centre in London, the Bank of England is going to have to get more creative with its monetary policy, especially if job losses acclerate in the second half of the year.

.

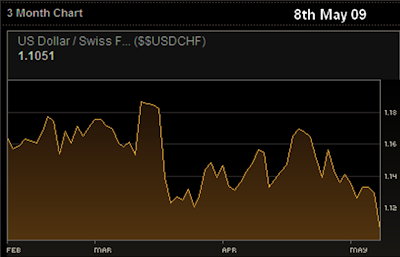

Swiss economy exports to the EU were struggling due to a strong Swiss Franc. The Swiss National Bank intervened in the currency markets, in order to stem the upward rise in the Swiss Franc. While it seems to have worked for a while, the Swiss Franc is rallying again!! Watch out for comments from the SNB if this trend continues.

.

Points to note:

- Expect more quantitative easing and competitive currency devaluations if the second half of 2009 turns out to be 'more challenging' than first expected.

- Unemployment could prove to be a major speed bump to any recovery. As I've said before, there are going to be a lot of angry people - whose homes and retirement funds and investments are falling in value. Many have debt to be repaid and a job loss will compound their problems.

- Policy makers may breathe easy for now, as the renewed optimism of a 'quick recovery' seems to have kept 'the mob' at bay for now. Fact is : They haven't found any viable long term fixes just yet and the crowds continue to grow impatient, albeit distracted for now by the rapid rally in the equity markets.

No comments:

Post a Comment