You really can fool all of the people all of the time (or so it would seem); Writedown after write down, Lies and more lies: and yet Wall Street believes in the Investment Banks!!! The DJIA was up over 266 points yesterday!

"Fool me once, shame on you. Fool me TEN TIMES!!, shame on me."

Investors just don't seem to get it yet.

On Thursday 17th July, 2008 Merrill Lynch lost $4.9 billion for the June quarter.

John Thain (Merrill's CEO) reiterated his stand that Merrill did not need to raise more capital. (By selling equity). http://www.iht.com/articles/2008/07/18/business/18merrill.php

12 DAYS later, a stock sale is announced !!!! Yes they need more capital AGAIN!!!

Meanwhile, Mr. Thain is also looking to sell stakes in Merrill’s valuable assets (Bloomberg LP and BlackRock Inc) to raise capital.

The Bullish Bear says-----------------

Merrill sold some $30.6 Bn worth of TOXIC CDO’s at 22 cents on the dollar.

- Firstly, after Merrill Lynch, who’s going to be next? http://www.forbes.com/wallstreet/2008/07/29/merrill-citi-banks-biz-wall-cx_lm_0729writedowns.html

- Did the CDO’s turn toxic overnight or in the last 12 days since the June quarterly result.

$ 30.6 Bn -> $ 11 Bn at the end of June -> $6.7Bn yesterday. - Was the sale triggered by the Undercapitalized Bond/ CDO Insurers who could not pay up?

- Was the sale cheaper than marking them to market (since the really toxic stuff may have no market) which may have triggered more confusion and asset fire sales?

- What is the market value of the ‘Toxic Securities’ of Bear Stearns that the FED now holds; not 22 cents on the dollar I hope??

Wall Street Credibility and Downside protection for Sovereign Wealth Funds

Yesterday, a further $ 8.55 Bn stock sale was announced, including a stock sale to TEMASEK (Investment Company of the Government of Singapore).

Thanks to a downside protection clause, Temasek will be compensated for the nearly 50% loss suffered on their December 2007 ‘bailout investment’ in Merrill Lynch.

As per the clause, if Merrill raised more capital in the 12 months following the Temasek deal, at a stock price of less than $48, Temasek would be compensated for the difference.

The Wall Street Journal calls it a Sweet Deal for Temasek. http://online.wsj.com/article/SB121735266454993851.html?mod=googlenews_wsjI would call it STREET SMART investing!!

When you must deal with someone whom you cannot trust completely, like bankers that just can’t be truthful and disclose to you the true value of their assets and liabilities:

You Protect Yourself.

This is definitely going to set a precedent, as new Capital becomes more expensive and comes with many strings attached.

Worse still, as investment banks look to dump Toxic CDO’s and avoid Mortgage related securities, the slowing MBS market is going to result in the unwillingness of Banks to lend to the Residential Housing market in the US.

If you are looking to buy the US Financials now that the worst is behind us - >Caveat emptor

As per the clause, if Merrill raised more capital in the 12 months following the Temasek deal, at a stock price of less than $48, Temasek would be compensated for the difference.

As per the clause, if Merrill raised more capital in the 12 months following the Temasek deal, at a stock price of less than $48, Temasek would be compensated for the difference.

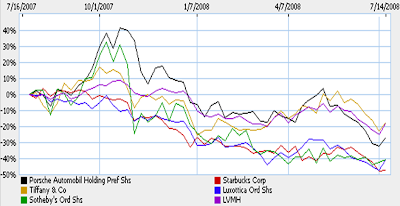

As Starbucks is closing down stores and fighting rising input costs, L’Oreal is moderating growth forecasts.

As Starbucks is closing down stores and fighting rising input costs, L’Oreal is moderating growth forecasts.

While they denied that Freddie Mac & Fannie Mae are insolvent, they claim that the GSEs are adequately capitalized.

While they denied that Freddie Mac & Fannie Mae are insolvent, they claim that the GSEs are adequately capitalized.

Tightening credit conditions and looming job cuts at London banks are contributing to negative sentiment in the housing market.

Tightening credit conditions and looming job cuts at London banks are contributing to negative sentiment in the housing market.