Re closes at record low of 50.48

Re closes at record low of 50.48Friday, February 27, 2009

Weakness in Asian currencies continues

Re closes at record low of 50.48

Re closes at record low of 50.48Thursday, February 26, 2009

Wednesday, February 25, 2009

Swaminathan Aiyar on the US Housing Market

Recreating a rotten system- Swaminathan S A Aiyar-Columnists ...

Tuesday, February 24, 2009

S&P reduces India’s rating outlook to negative from stable.

Source: India Lowers Taxes, Straining Finances as S&P May Cut to Junk

While global economic conditions continue to be stressful, I would like to focus on the highlighted section of the above quote.

We must not forget that India isn't the only country resorting to extraordinary measures in extraordinary times. I would like to also say that unlike certain governments globally, the Indian Government hasn't ''thrown good money after bad'', and to the credit of local regulators, we have not had a massive banking collapse at a local bank or suspended trading sessions on our stock exchanges so far. As compared to many Pension Funds overseas, Government Pension Funds in India are in great shape ,mainly due to massive restrictions on speculative investments by pension funds.

Given India's large agrarian population that lives in rural areas; the government will have to continue to support Indian farmers with fertilizer subsidies and loan waivers, even as efforts to spread literacy and education across smaller towns continue.

Better to support a farmer than a lying banker any day!!!

India's massive and rapidly expanding middle class is crucial to India's long term prosperity, and its expansion is key to establishing a more equitable distribution of wealth. As a result, fuel subsidies and cuts in Indirect taxes (read: Service Tax and Excise taxes) are likely to continue to burden government finances.

I find it rather ironic that the very forces that criticized the Indian Government just a few years ago about its 'snail slow ' reforms in the Indian Banking sector, are now 'nationalizing' and pumping endless amounts of money into bankrupt and overleveraged banks.

Lastly, remember to take these comments with a pinch of salt, as S&P were one of the 'experts' that gave 'AAA' ratings to toxic Subprime CDO's & now defunct Mortgage Bond Insurers. These guys also refused to recognise the suicidal risks taken by large investment banks and financial institutions until it was too late.

As for India's continued loose fiscal policy, S&P better analyse the ever expanding US TARPS a little more closely.

They may find they've got more downgrading to do!!!!!!

More Links on the S&P negative outlook

S&P cuts ratings outlook on 12 Indian banks to negative

India's ratings may take a hit: S&P

Indian rupee weakens on S&P's outlook downgrade

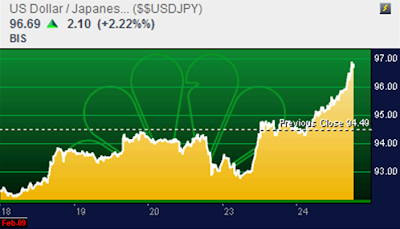

THE CURIOUS CASE OF THE JAPANESE YEN !

USDJPY (Japanese Yen to 1USD): The declining blue line in the graph above indicates a weakening USD and a thus a strengthening JPY.

Even as global stock markets retest recent lows, the rapid uptrend in the JPY seems to have come to an end. http://www.cnbc.com/id/24419477/

GDP data coming out of Japan has been terrible, as export oriented Japanese Blue Chip MNC's struggle with falling sales in the US Market. The strong JPY really hurt profits !

Has the dreadful fundamental data finally managed to overwhelm the unwinding of the Carry Trade?

OR

Have currency speculators sensed a trend shift and bailed out of the JPY all of a sudden?

OR

Are we finally seeing a reduction in risk aversion ? ( given the terrible economic data everywhere, I don't think thats possible just yet)

Edit : Bernanke Sees 2010 Economic Recovery `Only If' Markets, Banks Stabilize Just saw this headline on Bloomberg, so I guess risk aversion is here to stay !

WATCH THIS SPACE.

Friday, February 20, 2009

GOLD at $1000

Gold prices look overbought at the moment, but there's a lot of momentum in Gold, as the DJIA tests new lows. The currency situation in Eastern Europe is a mess and equity markets worldwide are retesting Oct/Nov 2008 lows!

Also, here are some interesting links from

Jesse's Café Américain Blog

China Invests in Production and Commodities While the US Feeds the Sharks

China Is Shopping the World for Miners and Commodities

The Chinese are planning ahead!

Tuesday, February 17, 2009

Monday, February 16, 2009

Hard Hitting comments on the Indian Railway Budget

The media proclaimed Laloo Prasad Yadav to be the expert who turned around this ailing public sector enterprise!!!!

"A rising tide lifts all boats." How is the Railways going to react to the impending slowdown in domestic and international trade?

Here is some very 'constructive' criticism of Railway Policies over the last 5- 6 years, that will hopefully encourage policies to reinvest in infrastructure and plan for long term growth opportunities of the Indian Railways.

""""

A tale of missed opportunities: Sumant Chak

BS Reporter / New Delhi February 14, 2009, 0:39 IST

The operational and financial performance sustained over the last five-six years has been commendable. Sadly, these are also years of missed opportunities, with capacity generation and modernisation of the system being the important casualties.

The system’s capacity to run trains has been exploited to saturation. The ground reality is that there has been no important capacity generation in the last five years. Similarly, older coaches, locomotives and wagons continue in service with no improvement in passenger comfort or freight carrying capacity. The dedicated freight corridor project, which signalled the intent to increase system’s capacity substantially, remains mostly on paper.

Similar is the case of a slew of projects announced over the years. Coach, wheel and locomotive factories that were promised some years back have languished in the files and none is even remotely close to fruition.

It is important to understand that the railway infrastructure is not created in a day. Unless project planning and execution are given priority, the country’s railway will not become world-class. The increasing populism in the last two budgets and this one, therefore, reflects a tale of missed opportunities. Future generations will rue today’s tardiness.Sumant Chak, Director (International Relations), Asian Institute of Transport Development, New Delhi Former Additional Railway Board member. """"

SOURCE:http://www.business-standard.com/india/news/a-talemissed-opportunities-sumant-chak/01/30/349017/

Thursday, February 12, 2009

TEMPERS FLARING!!!!!

Wednesday, February 11, 2009

Capitol Hill Marathon : Just smile and wave, boys. Smile and wave !

Private the Penguin: Skipper. Shouldn't we tell them that the boat is out of gas?

Skipper the Penguin: Nah! Just smile and wave, boys. Smile and wave. [all four penguins waving]

While they promised to take any action to prevent systemic failure and talked of a ‘deep loss of faith’ in the financial system, they said that actions must be as large as the problems we face!!!

More promises of fixing, addressing, and facilitating….and so on.

A housing market strategy is also due in a few weeks.

Here are Breaking News Flashes from CNBC of the Q&A session on Capitol Hill with Ben Bernanke.

Fixing ‘too big too fail’ problem should be a top priority.

Should work hard to restore ‘fiscal balance’ as soon as possible.

Credit markets no longer frozen by subprime problems.

Current financial crisis worst since the 1930’s.

Need strong action to boost economy.

We can’t expect immediate results.

95% of Fed’s Balance Sheet in very safe assets.

Doesn’t expect Fed will lose money on AIG & Bear Loans.

Concedes ‘too big to fail’ is not fair to smaller banks.

We’re not trying to prop up the price of housing.

Fed is trying to get lending going again.

Bank of America’s failure would have had bad consequences.

Fed watching AIG to make sure its expenditures are proper.

Foreign demand for U.S. Treasuries remains strong.

Feels comfortable Fed not facing large losses.

Eventually economy will recover & Fed will raise interest rates.

Thinks Fed would have a role in more systemic oversight.

Federal Reserve already has ‘substantial’ systemic responsibilities.

Doesn’t think earlier monetary policy was main source of Credit Crisis.

Credit markets now frozen due to economic concerns.

We have no ‘nefarious’ scheme; just trying to help economy recover.

Opposed to releasing information on overnight loans to banks.

Federal discount window borrowing shouldn’t be stigmatized.

Important to also get credit flowing outside the banks.

There was‘confusion’ over how to spend first $ 350 Bn of TARP.

Credit markets no longer frozen by subprime problems.

Congress should consider liquidity facility for municipalities.

Actions we’ve taken have prevented a much worse situation.

Inflation becomes more of a problem as the economy recovers.

Main risk of ‘Stagflation’ is if banking system is not fixed.

TALF program will be up and running in a couple of weeks.

Fed’s Balance Sheet is ‘profit center’ not a ‘loss center’.

Fed makes money by loaning at higher interest rates than it borrows.

Wednesday, February 4, 2009

SMART MONEY UNDERESTIMATING RISK !

Tales of Hedge Fund--Private Equity--Emerging Market Losses

Don't blame the bankers, some of these 'business schools' were clearly taking too much risk with Endowment and Pension fund investments - They should have known better!

The Bullish Bear Blog advises all Sovereign Wealth Funds : "'''Stop trusting bankers and quit investing in global financial institutions and banks.!"""

Saudi Prince Burned By Citigroup

Saudi's Kingdom Holding posts $8.3 bln Q4 loss

Abu Dhabi fund faces huge loss

Losses steep at sovereign-wealth funds

Report: Arab govt funds lost big as markets fell

Norway Oil Fund Losses in Lehman Shares Exacerbate Kingdom's Worst Return

Columbia Endowment Lost 15% in Second Half of 2008

Dartmouth to Cut Budget After Endowment Loses 18%

Cornell to Cut Spending After Endowment Falls 27%

Princeton Fund May Decline 25%, Tuition to Rise 2.9%

Harvard Alumni Protest Investors’ Pay After Fund Loss

Lessons learned from Harvard's 30% endowment loss - MarketWatch

Harvard Hit by Loss as Crisis Spreads to Colleges - WSJ.com

Harvard's Endowment Loses $8 Billion

Hopkins's endowment drops amid recession

Survey shows endowment losses at many institutions

Sliced: Endowment losses cut Jefferson Scholarships

Market Losses Tighten Screws On Colleges

CalPERS investment chief sees 'no place to hide' in the markets

Harvard, Dartmouth Losses May Widen on Private Equity

Sunday, February 1, 2009

WHO IS BROOKSLEY E. BORN ?

Here are some links on Brooksley E. Born and her attempt to impose greater regulation on derivatives.

http://en.wikipedia.org/wiki/Brooksley_E._Born

http://www.opednews.com/maxwrite/diarypage.php?did=10029

http://www.washingtonpost.com/wp-dyn/content/article/2008/10/14/AR2008101403343_pf.html

http://www.nytimes.com/2008/10/09/business/economy/09greenspan.html?_r=1&pagewanted=all

http://www.global-sisterhood-network.org/content/view/2205/59/

‘In 1997, Brooksley Born warned in congressional testimony that unregulated trading in derivatives could "threaten our regulated markets or, indeed, our economy without any federal agency knowing about it." Born called for greater transparency -- disclosure of trades and reserves as a buffer against losses. Instead of heeding this oracle's warnings, Greenspan, Rubin & Summers rushed to silence her.’

http://www.democraticunderground.com/discuss/duboard.php?az=show_mesg&forum=389&topic_id=4221335&mesg_id=4221335

According to Wikipedia, she has declined to comment on the unfolding crisis.

I couldn't find any recent comments, so I guess she's not talking!!!!!

TOO LITTLE TOO LATE ?http://www.nytimes.com/imagepages/2008/10/09/business/09greenspan.graphix.ready.html