In an article titled : Cramer: Sell, Sell, Sell ; posted by Tom Brennan, this is what Cramer had to say!!!

"""Cramer’s bottom line for this market: “If you’re already on the sidelines, stay there. If you’re not, keep on selling until you get that cash up to a respectable level and then go buy some gold."""" http://www.cnbc.com/id/26840500

From his demands and pleadings for FED Bailouts and Rate cuts to his calls on a bottom in housing and financial firms-----

This new call had me stunned!!!

STAY ON THE SIDELINES AND BUY GOLD--------------never thought I'd hear that from a CNBC news anchor.

(Unlike Jim Cramer, I still think the U.S. Housing market will see more down side)

We are indeed in desperate, uncertain times:

Capital Preservation not Wealth Creation should be our primary concern.

Tuesday, September 23, 2008

Monday, September 22, 2008

Sunday, September 21, 2008

Headlines from a FREE MARKET!

Treasury Seeks Authority to Buy Mortgages Unchecked by Courts

Sept. 21, 2008 (Bloomberg)

http://www.bloomberg.com/apps/news?pid=20601087&sid=ae6b6P1L8E_E&refer=home

Paulson Plan May Spark Showdown Between Democrats, Republicans

Sept. 21, 2008 (Bloomberg)

http://www.bloomberg.com/apps/news?pid=20601087&sid=almXrJDtT2TY&refer=home

Paulson Bailout Plan Is Either `Worst' Approach or `Giant Step'

Sept. 19, 2008 (Bloomberg)

http://www.bloomberg.com/apps/news?pid=20601087&sid=aIpE3XaHDNwA&refer=home

Tab for financial bailout: $700 billion

Los Angeles Times Staff Writers, September 21, 2008

http://www.latimes.com/news/nationworld/nation/la-na-wallstreet21-2008sep21,0,1208602.story

Paulson Begins The PR Offensive

Sept. 20, 2008 (Forbes.com)

http://www.forbes.com/businessinthebeltway/2008/09/20/paulson-bailout-pr-biz-belt-cx_jz_0920paulsonshows.html

Seven Days that Shook Wall Street

http://www.businessweek.com/bwdaily/dnflash/content/sep2008/db20080919_945045.htm?chan=rss_topStories_ssi_5

President Bush's remarks on the economy

http://ap.google.com/article/ALeqM5gltEeAKv74u88ZAtyj5m-GjMeAQAD93AJC7G0

Americans take out frustrations with Wall Street

http://www.freep.com/apps/pbcs.dll/article?AID=/20080921/BUSINESS07/809210405

Bailout: ‘Whatever it takes’

http://www.chicagotribune.com/business/chi-sat-financial-rescue-sep20,0,2525209.story

Bush defends $800b bank bailout (ABC News)

http://www.abc.net.au/news/stories/2008/09/21/2369995.htm?section=justin

Market gain a 21-year high on on financial rescue plan, but investors not out of woods yet

http://canadianpress.google.com/article/ALeqM5hU_Qx0OSSCE98whi4YRCjMW4Sd8g

Sept. 21, 2008 (Bloomberg)

http://www.bloomberg.com/apps/news?pid=20601087&sid=ae6b6P1L8E_E&refer=home

Paulson Plan May Spark Showdown Between Democrats, Republicans

Sept. 21, 2008 (Bloomberg)

http://www.bloomberg.com/apps/news?pid=20601087&sid=almXrJDtT2TY&refer=home

Paulson Bailout Plan Is Either `Worst' Approach or `Giant Step'

Sept. 19, 2008 (Bloomberg)

http://www.bloomberg.com/apps/news?pid=20601087&sid=aIpE3XaHDNwA&refer=home

Tab for financial bailout: $700 billion

Los Angeles Times Staff Writers, September 21, 2008

http://www.latimes.com/news/nationworld/nation/la-na-wallstreet21-2008sep21,0,1208602.story

Paulson Begins The PR Offensive

Sept. 20, 2008 (Forbes.com)

http://www.forbes.com/businessinthebeltway/2008/09/20/paulson-bailout-pr-biz-belt-cx_jz_0920paulsonshows.html

Seven Days that Shook Wall Street

http://www.businessweek.com/bwdaily/dnflash/content/sep2008/db20080919_945045.htm?chan=rss_topStories_ssi_5

President Bush's remarks on the economy

http://ap.google.com/article/ALeqM5gltEeAKv74u88ZAtyj5m-GjMeAQAD93AJC7G0

Americans take out frustrations with Wall Street

http://www.freep.com/apps/pbcs.dll/article?AID=/20080921/BUSINESS07/809210405

Bailout: ‘Whatever it takes’

http://www.chicagotribune.com/business/chi-sat-financial-rescue-sep20,0,2525209.story

Bush defends $800b bank bailout (ABC News)

http://www.abc.net.au/news/stories/2008/09/21/2369995.htm?section=justin

Market gain a 21-year high on on financial rescue plan, but investors not out of woods yet

http://canadianpress.google.com/article/ALeqM5hU_Qx0OSSCE98whi4YRCjMW4Sd8g

Labels:

CRASH,

CREDIT CRISIS,

CURRENCY,

EURO,

US DOLLAR,

US ECONOMY,

US FED,

US FINANCIALS,

US HOUSING MARKET,

US RECESSION,

US SLOWDOWN,

WRITE DOWN

Saturday, September 20, 2008

GOLD - REACTING TO THE CREDIT CRISIS

The Bull market in Gold continues, and prices are nowhere near the record highs of $850 in 1980.

The Bull market in Gold continues, and prices are nowhere near the record highs of $850 in 1980.Using the Inflation calculator of the U.S. Department of Labor (Bureau of Labor Statistics),

$ 850 in 1980 has the same buying power as $2,259.99 in 2008.

Expect more volatility next week, both in Gold and the Equity markets. For now Gold needs to consolidate in the mid 800's for a while longer, before its next upmove. It is above its crucial long term support - the 300 Day MA currently at $840.67

Labels:

CRASH,

CREDIT CRISIS,

GOLD,

GOLD 300 DAY MA,

US RECESSION,

US SLOWDOWN,

WRITE DOWN

AMERICAN CAPITALISM & THE EMPEROR'S NEW CLOTHES!

The FED and the US Treasury have done it again. Hooray ! We’ve been saved!

Markets around the world rallied furiously and confidence has been magically restored. The Financial media is talking about how wonderful the whole scheme is!

Restoring confidence and punishing manipulative shortsellers!!

At the end of the day, the markets have rallied and everyone can have a good weekend. Everyone except the FED and the Treasury, who are going to have to come up with a detailed plan soon, (if they haven’t done so already.)

Well here are the Free Market guidelines they are working by -

Privatize Profits, Socialize Risk and losses.

Stop short selling in financial stocks; Blame the short sellers, and not the incompetent and bungling regulators, Fed, Treasury and overpaid Investment Bank CEO’s that got us into this mess in the first place.

Surprising that Crude Oil futures were not suspended on grounds of market manipulation !

Bailout everyone who took on more risk than they could cope with.

Punish Creditworthy debtors by rewarding defaulters and leveraged overtraders.

Conduct Bailouts on a case by case basis, randomly deciding who is to big to (let) fail.

Coming to the Story of the Emperor’s new clothes, starring Hank Paulson and Ben Bernanke as 'the illustrious tailors'.

Heres the summary from Wikipedia

“An emperor who cares too much about clothes hires two swindlers who promise him the finest suit of clothes from the most beautiful cloth. This cloth, they tell him, is invisible to anyone who was either stupid or unfit for his position. The Emperor cannot see the (non-existent) cloth, but pretends that he can for fear of appearing stupid; his ministers do the same. When the swindlers report that the suit is finished, they dress him in mime. The Emperor then goes on a procession through the capital showing off his new "clothes". During the course of the procession, a small child cries out, "But he has nothing on!" The crowd realizes the child is telling the truth. The Emperor, however, holds his head high and continues the procession.”

http://en.wikipedia.org/wiki/The_Emperor

The Question is : How long can this go on??

Delaying tactics may postpone the day of judgement for a while, and although the authorities may promise you that they are taking unprecedented measures under extraordinary circumstances,----we may be running out of road!!

Gold has survived a most volatile week, closing around $ 872 today on news of the continuing credit crisis. Increases in money supply and ‘fighting insolvency with liquidity’ are going the be factors that will drive gold prices still higher

The coming week or should I say weekend should be interesting!

Some excellent coverage of the volatile week -

http://globaleconomicanalysis.blogspot.com/2008/09/us-taxpayer-giant-dumpster-for-illiquid.html

http://www.financialarmageddon.com/2008/09/be-careful-what.html

http://economicdisconnect.blogspot.com/2008/09/pandemonium-of-clueless.html

http://www.nakedcapitalism.com/2008/09/ban-on-short-selling-will-hurt-rather.html

Markets around the world rallied furiously and confidence has been magically restored. The Financial media is talking about how wonderful the whole scheme is!

Restoring confidence and punishing manipulative shortsellers!!

At the end of the day, the markets have rallied and everyone can have a good weekend. Everyone except the FED and the Treasury, who are going to have to come up with a detailed plan soon, (if they haven’t done so already.)

Well here are the Free Market guidelines they are working by -

Privatize Profits, Socialize Risk and losses.

Stop short selling in financial stocks; Blame the short sellers, and not the incompetent and bungling regulators, Fed, Treasury and overpaid Investment Bank CEO’s that got us into this mess in the first place.

Surprising that Crude Oil futures were not suspended on grounds of market manipulation !

Bailout everyone who took on more risk than they could cope with.

Punish Creditworthy debtors by rewarding defaulters and leveraged overtraders.

Conduct Bailouts on a case by case basis, randomly deciding who is to big to (let) fail.

Coming to the Story of the Emperor’s new clothes, starring Hank Paulson and Ben Bernanke as 'the illustrious tailors'.

Heres the summary from Wikipedia

“An emperor who cares too much about clothes hires two swindlers who promise him the finest suit of clothes from the most beautiful cloth. This cloth, they tell him, is invisible to anyone who was either stupid or unfit for his position. The Emperor cannot see the (non-existent) cloth, but pretends that he can for fear of appearing stupid; his ministers do the same. When the swindlers report that the suit is finished, they dress him in mime. The Emperor then goes on a procession through the capital showing off his new "clothes". During the course of the procession, a small child cries out, "But he has nothing on!" The crowd realizes the child is telling the truth. The Emperor, however, holds his head high and continues the procession.”

http://en.wikipedia.org/wiki/The_Emperor

The Question is : How long can this go on??

Delaying tactics may postpone the day of judgement for a while, and although the authorities may promise you that they are taking unprecedented measures under extraordinary circumstances,----we may be running out of road!!

Gold has survived a most volatile week, closing around $ 872 today on news of the continuing credit crisis. Increases in money supply and ‘fighting insolvency with liquidity’ are going the be factors that will drive gold prices still higher

The coming week or should I say weekend should be interesting!

Some excellent coverage of the volatile week -

http://globaleconomicanalysis.blogspot.com/2008/09/us-taxpayer-giant-dumpster-for-illiquid.html

http://www.financialarmageddon.com/2008/09/be-careful-what.html

http://economicdisconnect.blogspot.com/2008/09/pandemonium-of-clueless.html

http://www.nakedcapitalism.com/2008/09/ban-on-short-selling-will-hurt-rather.html

Labels:

CENTRAL BANKS,

CRASH,

CREDIT CRISIS,

CURRENCY,

GOLD,

SWISS FRANC,

US DOLLAR,

US ECONOMY,

US FED,

US FINANCIALS,

US RECESSION,

US SLOWDOWN,

WRITE DOWN

Friday, September 19, 2008

$ 247 Billion - Just how much is that anyway?

Today,Central Banks around the world worked together to ease the liquidity crunch.

'''The Cash injection package '''to the tune of $ 247 Billion, to calm global financial markets, tells us that we are indeed in desperate times.

Read on below to get an idea of how large that sum of money actually is !!!!

At the current USD/INR exchange rate of approx. 46 ( 1$ = INR 46),

$ 247 Billion works out to

Rs 11, 36,200 Crores.

To put that into perspective for Indian Investors, the current marketcap of the NSE Nifty 50 Index as of yesterday's close is Rs. 24,57,226 Crores ( ie Rs. 245,72,261 Million) .

Meanwhile US Markets rallied sharply towards the end of the trading day as Hank Paulson is now proposing a massive bailout package for the financial sector!!!!!!!!!!!!!! AGAIN!!

Gold fell sharply to $853 after briefly rising over $ 900 earlier in the day.

Dangerous but interesting times!!!

'''The Cash injection package '''to the tune of $ 247 Billion, to calm global financial markets, tells us that we are indeed in desperate times.

Read on below to get an idea of how large that sum of money actually is !!!!

At the current USD/INR exchange rate of approx. 46 ( 1$ = INR 46),

$ 247 Billion works out to

Rs 11, 36,200 Crores.

To put that into perspective for Indian Investors, the current marketcap of the NSE Nifty 50 Index as of yesterday's close is Rs. 24,57,226 Crores ( ie Rs. 245,72,261 Million) .

Meanwhile US Markets rallied sharply towards the end of the trading day as Hank Paulson is now proposing a massive bailout package for the financial sector!!!!!!!!!!!!!! AGAIN!!

Gold fell sharply to $853 after briefly rising over $ 900 earlier in the day.

Dangerous but interesting times!!!

Labels:

CRASH,

CREDIT CRISIS,

CURRENCY,

INDIAN EQUITY,

US RECESSION,

US SLOWDOWN,

WRITE DOWN

Thursday, September 18, 2008

US FINANCIALS : D - DAY

I've said it time and again, you just can't trust these guys!!!! Countrywide Financial - Bear Stearns - Freddie Mac - Fannie Mae - Lehman Bros - AIG...and a few more big names all set to join the list.

Countrywide Financial - Bear Stearns - Freddie Mac - Fannie Mae - Lehman Bros - AIG...and a few more big names all set to join the list.

Countrywide Financial - Bear Stearns - Freddie Mac - Fannie Mae - Lehman Bros - AIG...and a few more big names all set to join the list.

Countrywide Financial - Bear Stearns - Freddie Mac - Fannie Mae - Lehman Bros - AIG...and a few more big names all set to join the list.You may blame the short sellers for the steep stock declines, but the blame lies squarely with incompetent regulators, CEOs and management and risk managers, whose models never seemed to figure out the dangers of overleveraged derivative positions and the simple fact that home prices would not rise forever!

Labels:

CENTRAL BANKS,

CRASH,

CREDIT CRISIS,

CURRENCY,

EURO,

FANNIE MAE,

FREDDIE MAC,

US DOLLAR,

US ECONOMY,

US FED,

US FINANCIALS,

US RECESSION,

US SLOWDOWN

GOLD - THE FLIGHT 2 SAFETY

For the past few days, I have been puzzled at the movements in the GOLD price, given all the turmoil in global financial markets. Although I added to my gold positions yesterday, I thought I would delay todays purchase until tomorrow, expecting a better price!!!!!! Well I just missed a 11 % rally in the precious metal!!!!!!!

Well I just missed a 11 % rally in the precious metal!!!!!!!

BY A SINGLE TRADING SESSION !!!!!!!!!!!!!

Investment bank CEO's may blame the short sellers and try to calm panic stricken investors, but it appears that the overleveraged CDO, CDS mess is derailing the US economy at the moment.

Investment bank CEO's may blame the short sellers and try to calm panic stricken investors, but it appears that the overleveraged CDO, CDS mess is derailing the US economy at the moment.

Well I just missed a 11 % rally in the precious metal!!!!!!!

Well I just missed a 11 % rally in the precious metal!!!!!!!BY A SINGLE TRADING SESSION !!!!!!!!!!!!!

Although prices were pretty flat through the Indian trading session ( despite news of the AIG Bailout which came in about mid day IST), in the US trading session, Gold rose sharply as fears of further bankruptcies across global financial firms triggered a flight to safety!!!

I'm not sure how much short covering contributed to today's rally, but things are getting pretty serious. Panics of this magnitude are extremely dangerous, as solvent firms can get dragged down by the overleveraged collapsing ones.

The USD rally over the past week appears to have stalled, but I would not be surprised to see gold rally, even as the USD holds out for a while longer, as the selloff across various asset classes continues.

Investment bank CEO's may blame the short sellers and try to calm panic stricken investors, but it appears that the overleveraged CDO, CDS mess is derailing the US economy at the moment.

Investment bank CEO's may blame the short sellers and try to calm panic stricken investors, but it appears that the overleveraged CDO, CDS mess is derailing the US economy at the moment.Interesting times...........watch this space!

Labels:

CRASH,

CREDIT CRISIS,

GOLD,

GOLD 300 DAY MA,

GOLDILOCKS ECONOMY,

US RECESSION,

US SLOWDOWN,

USDX,

WRITE DOWN

Friday, September 12, 2008

BAILOUTS: HERE WE GO AGAIN

In my November 2007 post, I quoted the last two paragraphs of the book ' The Great Crash 1929 ' by the late John Kenneth Galbraith. Well here they are again.

" Wall Street, in recent times, has become, as a learned phrase has it, very 'public relations conscious'. Since a speculative collapse can only follow a speculative boom, one might expect that Wall Street would lay a heavy hand on any resurgence of speculation. The Federal Reserve would be asked by bankers and brokers to lift margins to the limit; it would be warned to enforce the requirement sternly against those who might try try to borrow on their own stocks and bonds in order to buy more of them. The public would be warned sharply and often of the risks inherent in buying stocks for the rise. Those who persisted, nonetheless, would have no one to blame but themselves. The position of the Stock Exchange, its members, the banks, and the financial community in general would be perfectly clear and as well protected in the event of a further collapse as sound public relations allow,

As noted, all this might logically be expected. It will not come to pass. This is not because the instinct for self-preservation in Wall Street is poorly developed. On the contrary, it is probably normal and may be above. But now, as throughout history, financial capacity and political perspicacity are inversely correlated. Long-run salvation by men of business has never been highly regarded if it means disturbance of orderly life and convenience in the present. So inaction will be advocated in the present even though it means deep trouble in the future. Here, at least equally with communism, lies the threat to capitalism. It is what causes men who know that things are going quite wrong to say that things are fundamentally sound.''

The book was first published in 1954, and provides a detailed account of the events leading upto the 1929 crash and the consequences thereafter.

The last paragraph, sums up the situation in which we find world markets today.

Banks failing after markets close on Friday, Bailout packages announced on Sundays & bailouts and deals without any long term solution in mind.

Countrywide Financial, Bear Stearns, Freddie Mac, Fannie Mae, and now maybe Lehman Brothers: all too big to (let) fail!!!

Well the times they are a-changin!!

http://www.bobdylan.com/#/songs/times-they-are-changin

The current leadership had better sit up and take notice, before they steer our ship right off the cliff !!

" Wall Street, in recent times, has become, as a learned phrase has it, very 'public relations conscious'. Since a speculative collapse can only follow a speculative boom, one might expect that Wall Street would lay a heavy hand on any resurgence of speculation. The Federal Reserve would be asked by bankers and brokers to lift margins to the limit; it would be warned to enforce the requirement sternly against those who might try try to borrow on their own stocks and bonds in order to buy more of them. The public would be warned sharply and often of the risks inherent in buying stocks for the rise. Those who persisted, nonetheless, would have no one to blame but themselves. The position of the Stock Exchange, its members, the banks, and the financial community in general would be perfectly clear and as well protected in the event of a further collapse as sound public relations allow,

As noted, all this might logically be expected. It will not come to pass. This is not because the instinct for self-preservation in Wall Street is poorly developed. On the contrary, it is probably normal and may be above. But now, as throughout history, financial capacity and political perspicacity are inversely correlated. Long-run salvation by men of business has never been highly regarded if it means disturbance of orderly life and convenience in the present. So inaction will be advocated in the present even though it means deep trouble in the future. Here, at least equally with communism, lies the threat to capitalism. It is what causes men who know that things are going quite wrong to say that things are fundamentally sound.''

The book was first published in 1954, and provides a detailed account of the events leading upto the 1929 crash and the consequences thereafter.

The last paragraph, sums up the situation in which we find world markets today.

Banks failing after markets close on Friday, Bailout packages announced on Sundays & bailouts and deals without any long term solution in mind.

Countrywide Financial, Bear Stearns, Freddie Mac, Fannie Mae, and now maybe Lehman Brothers: all too big to (let) fail!!!

Well the times they are a-changin!!

http://www.bobdylan.com/#/songs/times-they-are-changin

The current leadership had better sit up and take notice, before they steer our ship right off the cliff !!

Labels:

CENTRAL BANKS,

CRASH,

STAGFLATION,

US RECESSION,

US SLOWDOWN,

WRITE DOWN

Wednesday, September 10, 2008

FRANNIE : Privatizing Profits & Socializing losses:

It started with : THERE WILL BE NO BAILOUT! BECAUSE WE DON’T NEED ONE !

http://www.forbes.com/2008/07/11/dodd-fannie-freddie-biz-wash-cx_bw_0711housing.html

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a7gQ4D5KgrIQ

http://www.pbs.org/newshour/updates/business/july-dec08/paulson_07-11.html

http://www.independent.ie/business/world/departing-paulson-says-no--bailout-for-fannie-and-freddie-1452477.html

Well that’s all folks! Bailout done and done!!

Privatizing Profits & Socializing losses:

Bailing out homeowners who borrowed way more than they could ever repay

Bailing out banks that were downright reckless while issuing these loans

Bailing out the investment banks that created a CDO web so complex that they don’t know what they own, let alone value these securities.

And finally making the tax payer the paymaster of the whole catastrophe!

Talk about long term damage to integrity of the financial system!!!

2008 has been a year of immense strain for world financial markets, one shock after another, with no end to the bad news in sight. Sunday’s actions make the Bear Stearns debacle look like child’s play. Each shock is worse than the last one, and the men at the helm continue to reassure us that everything’s under control. Imagine if things took a turn for the worse!!!

The one thing I found really incredible was the continued strength in the USD and weakness in Precious metals even after the announcement.

National debt is going through the roof, the housing market continues to seek lower levels, inflation and unemployment are rising!!! and no one seems to care, and the USD rally continues

Well, what’s coming up next?

Will we see the GSE’s now shrink their Mortgage Portfolios?

How will this impact the housing market?

Can they issue shares to the Treasury in the future if they can’t pay up on promised Preferred stock dividends?

Are we going to see a rate cut from the FED?

So who’s next Washington Mutual or Lehman Brothers?

_______________________________________________

BIG PICTURE covers it well.

http://bigpicture.typepad.com/comments/2008/09/fannie-freddi-2.html

Well, if the bailouts not enough, the lets tweak the taxation laws for the GSEs

http://www.nakedcapitalism.com/2008/09/paulson-gives-fannie-and-freddie-tax.html

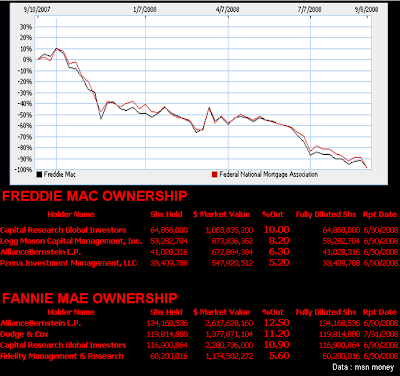

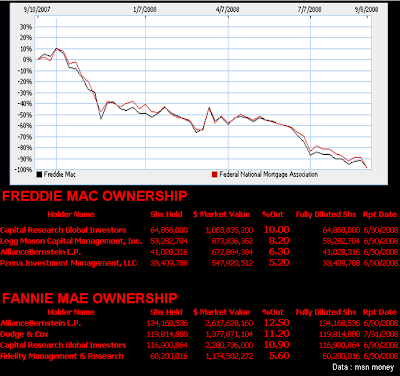

Well the shares are now where they should be! Heres who owns them/ did until a few months ago!!!

http://blogs.wsj.com/deals/2008/09/08/who-is-taking-the-big-hits-on-fannie-freddie-shares/

Jim Rogers on the Bailout

Jim Rogers on the Bailout

http://www.moneymorning.com/2008/09/06/jim-rogers-book/

US Is "More Communist than China": Jim Rogers

http://www.cnbc.com/id/26603489

Other links worth a read

http://seekingalpha.com/article/94218-8-quick-comments-on-the-freddie-fannie-bailout-plan

http://www.nakedcapitalism.com/2008/09/ny-times-fannie-freddie-nationalization.html

http://www.nakedcapitalism.com/2008/09/freddie-fannie-notable-comments-mainly.html

http://www.financialarmageddon.com/2008/09/one-of-many-sca.html

http://www.financialarmageddon.com/2008/09/dont-say-you-we.html

http://www.bloomberg.com/apps/news?pid=20601087&sid=aQwEq.iCBzMk&refer=home

http://www.ft.com/cms/s/0/b349ff60-7cd8-11dd-8d59-000077b07658.html?nclick_check=1

http://www.ustreas.gov/press/releases/hp1129.htm

http://www.forbes.com/2008/07/11/dodd-fannie-freddie-biz-wash-cx_bw_0711housing.html

http://www.bloomberg.com/apps/news?pid=newsarchive&sid=a7gQ4D5KgrIQ

http://www.pbs.org/newshour/updates/business/july-dec08/paulson_07-11.html

http://www.independent.ie/business/world/departing-paulson-says-no--bailout-for-fannie-and-freddie-1452477.html

Well that’s all folks! Bailout done and done!!

Privatizing Profits & Socializing losses:

Bailing out homeowners who borrowed way more than they could ever repay

Bailing out banks that were downright reckless while issuing these loans

Bailing out the investment banks that created a CDO web so complex that they don’t know what they own, let alone value these securities.

And finally making the tax payer the paymaster of the whole catastrophe!

Talk about long term damage to integrity of the financial system!!!

2008 has been a year of immense strain for world financial markets, one shock after another, with no end to the bad news in sight. Sunday’s actions make the Bear Stearns debacle look like child’s play. Each shock is worse than the last one, and the men at the helm continue to reassure us that everything’s under control. Imagine if things took a turn for the worse!!!

The one thing I found really incredible was the continued strength in the USD and weakness in Precious metals even after the announcement.

National debt is going through the roof, the housing market continues to seek lower levels, inflation and unemployment are rising!!! and no one seems to care, and the USD rally continues

Well, what’s coming up next?

Will we see the GSE’s now shrink their Mortgage Portfolios?

How will this impact the housing market?

Can they issue shares to the Treasury in the future if they can’t pay up on promised Preferred stock dividends?

Are we going to see a rate cut from the FED?

So who’s next Washington Mutual or Lehman Brothers?

_______________________________________________

BIG PICTURE covers it well.

http://bigpicture.typepad.com/comments/2008/09/fannie-freddi-2.html

Well, if the bailouts not enough, the lets tweak the taxation laws for the GSEs

http://www.nakedcapitalism.com/2008/09/paulson-gives-fannie-and-freddie-tax.html

Well the shares are now where they should be! Heres who owns them/ did until a few months ago!!!

http://blogs.wsj.com/deals/2008/09/08/who-is-taking-the-big-hits-on-fannie-freddie-shares/

Jim Rogers on the Bailout

Jim Rogers on the Bailouthttp://www.moneymorning.com/2008/09/06/jim-rogers-book/

US Is "More Communist than China": Jim Rogers

http://www.cnbc.com/id/26603489

Other links worth a read

http://seekingalpha.com/article/94218-8-quick-comments-on-the-freddie-fannie-bailout-plan

http://www.nakedcapitalism.com/2008/09/ny-times-fannie-freddie-nationalization.html

http://www.nakedcapitalism.com/2008/09/freddie-fannie-notable-comments-mainly.html

http://www.financialarmageddon.com/2008/09/one-of-many-sca.html

http://www.financialarmageddon.com/2008/09/dont-say-you-we.html

http://www.bloomberg.com/apps/news?pid=20601087&sid=aQwEq.iCBzMk&refer=home

http://www.ft.com/cms/s/0/b349ff60-7cd8-11dd-8d59-000077b07658.html?nclick_check=1

http://www.ustreas.gov/press/releases/hp1129.htm

Subscribe to:

Posts (Atom)