WATCH THIS SPACE

Amidst the total chaos in world financial markets, gold has remained fairly stable.

Amidst the total chaos in world financial markets, gold has remained fairly stable.

Even as the US Equity markets rallied late on Friday, the Gold rally seems to have gone unnoticed on CNBC (big surprise!!!).

Even as the US Equity markets rallied late on Friday, the Gold rally seems to have gone unnoticed on CNBC (big surprise!!!).

Now this is something that caught my attention!!!!!

What the heck is going on!!

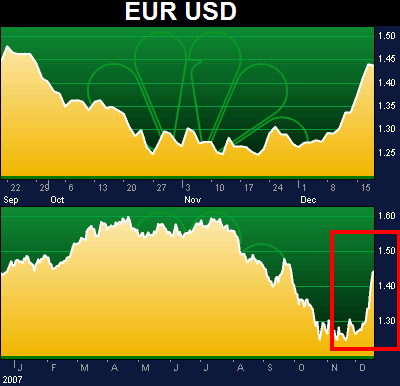

The whole world is falling apart and the OTC Derivative time-bomb continues to grow.

It going to turn nasty, that’s for sure. Amidst talks of Clearing Houses for derivatives, Fed & Treasury Bailouts for anyone who may be too big to fail ( or possibly too big to save), it seems that the authorities are just keen to buy time and hope this whole mess just goes away.

Counterparty defaults and Bankruptcies are going to add fuel to this OTC derivative bonfire.

Who is Anna Schwartz?

She is a revered economist at the National Bureau of Economic Research in New York City, and is about to turn 93! Yes, she was born in 1915!!!

She worked with Milton Friedman on ''A Monetary History of the United States, 1867-1960'' and is the one person who has really been around long enough, to make sense of the current state of chaos.

She expresses disappointment at the ad hoc program announcements by the authorities, which have only undermined faith in the US Financial system.

She also disagrees with the Fed’s idea that the only solution to our current problems is to flood the system with liquidity.

Anna Schwartz -

I think she makes some really valid points.

The President elect is in for a baptism by fire. I don’t think he has a solution, but I hope new actions don’t worsen the current chaotic pandemonium. As the unemployment rate rises and underfunded pension funds face market stress and healthcare costs escalate, 2009 is going to be a terrible year for Barack Obama. Good luck to him, and lets hope that he takes note of Anna Schwartz’s words of wisdom!

Source Links:

http://online.barrons.com/article/SB122489726575668975.html?mod=googlenews_barrons

http://en.wikipedia.org/wiki/Anna_Schwartz

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/2782488/Anna-Schwartz-blames-Fed-for-sub-prime-crisis.html

http://online.wsj.com/article/SB122428279231046053.html

http://economistsview.typepad.com/economistsview/2008/10/anna-schwartz-o.html

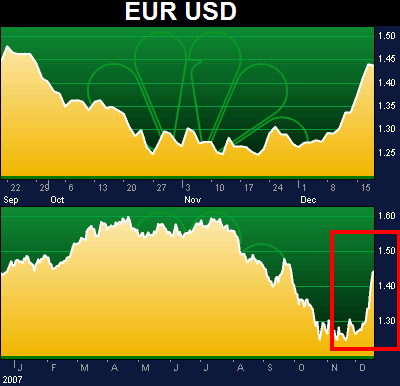

The Litmus test of the current USD strength will occur in January next year, when USD Holders must ask themselves if they are actually safe in the currency of a ‘bankrupt nation’ whose Asian creditors are perplexed and now annoyed by the chaotic manner in which the US Leadership has let their ship run aground.

ACTIONS & CONSEQUENCES

More updates on specific markets in coming posts.

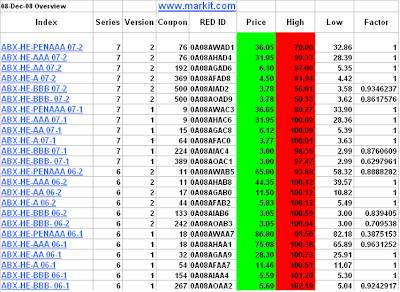

The currency has collapsed, banks have gone bust and the market closed down 77% to a level of 678.4, its lowest levels since April 2006.

The currency has collapsed, banks have gone bust and the market closed down 77% to a level of 678.4, its lowest levels since April 2006. Now that's a dead cat bounce!!

Now that's a dead cat bounce!! The Nikkei 225 has really tanked!!!!

The Nikkei 225 has really tanked!!!!

Until recently Fertilizer stocks were skyrocketing ( Potash & Mosaic), as fertilizer demand and food grain prices rose sharply. You had to buy coal stocks(Peabody Energy), as Chinese demand was growing exponentially and crude oil prices were going to $200. The bankers/finance people and their BlackBerries (RIM)were taking over the world, as were the Apple iPhone & iPod. And last but not the least you had to own Goldman Sachs- the one firm that could survive and thrive no matter how bad things got.

Until recently Fertilizer stocks were skyrocketing ( Potash & Mosaic), as fertilizer demand and food grain prices rose sharply. You had to buy coal stocks(Peabody Energy), as Chinese demand was growing exponentially and crude oil prices were going to $200. The bankers/finance people and their BlackBerries (RIM)were taking over the world, as were the Apple iPhone & iPod. And last but not the least you had to own Goldman Sachs- the one firm that could survive and thrive no matter how bad things got. Punter favourites like Jaiprakash Associates ( which rallied despite no significant change in its fundamentals) are now back to square one. Real Estate Developers like HDIL and DLF have crashed over 73% from their 52week highs - These were a must own at one stage, as India needed housing, and surging property prices appeared to have no effect on end user & investor demand. Anil Ambani's Reliance Industrial Infrastructure ( and other group companies like Reliance Power) tanked- as irrational valuations were pricing in projects to be executed years down the line. ICICI BANK is down over 65% from its 52week highs!! MTM losses from its International operations and solvency fears are driving the stock price still lower. Analysts had prevoiusly valued the sum of parts valuation of its Asset Management + Insurance + Banking businesses at well above the current stock price.

Punter favourites like Jaiprakash Associates ( which rallied despite no significant change in its fundamentals) are now back to square one. Real Estate Developers like HDIL and DLF have crashed over 73% from their 52week highs - These were a must own at one stage, as India needed housing, and surging property prices appeared to have no effect on end user & investor demand. Anil Ambani's Reliance Industrial Infrastructure ( and other group companies like Reliance Power) tanked- as irrational valuations were pricing in projects to be executed years down the line. ICICI BANK is down over 65% from its 52week highs!! MTM losses from its International operations and solvency fears are driving the stock price still lower. Analysts had prevoiusly valued the sum of parts valuation of its Asset Management + Insurance + Banking businesses at well above the current stock price. Source: http://sharedata.lloydstsbsharedealing.com/en/money/interest/index.html

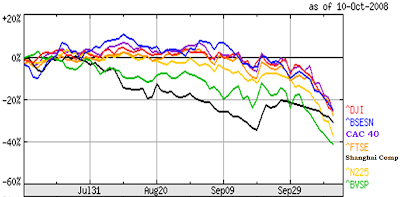

Source: http://sharedata.lloydstsbsharedealing.com/en/money/interest/index.html Stock markets around the world are tanking, Banks are not lending, and immense wealth destruction is taking place. It is almost unreal-- as Large capitalisation stocks around the world are down 10-20% in a single trading session.

Stock markets around the world are tanking, Banks are not lending, and immense wealth destruction is taking place. It is almost unreal-- as Large capitalisation stocks around the world are down 10-20% in a single trading session.

The Bull market in Gold continues, and prices are nowhere near the record highs of $850 in 1980.

The Bull market in Gold continues, and prices are nowhere near the record highs of $850 in 1980.

Countrywide Financial - Bear Stearns - Freddie Mac - Fannie Mae - Lehman Bros - AIG...and a few more big names all set to join the list.

Countrywide Financial - Bear Stearns - Freddie Mac - Fannie Mae - Lehman Bros - AIG...and a few more big names all set to join the list. Well I just missed a 11 % rally in the precious metal!!!!!!!

Well I just missed a 11 % rally in the precious metal!!!!!!! Investment bank CEO's may blame the short sellers and try to calm panic stricken investors, but it appears that the overleveraged CDO, CDS mess is derailing the US economy at the moment.

Investment bank CEO's may blame the short sellers and try to calm panic stricken investors, but it appears that the overleveraged CDO, CDS mess is derailing the US economy at the moment.