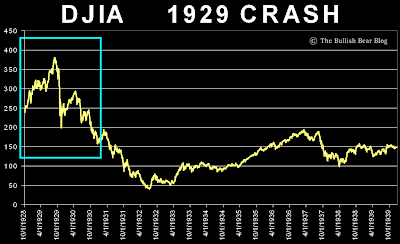

Looking at these charts, its easy to see the similar manner in which markets fell, after hitting all times highs, in 1929 and 2007. (Click on the charts for a closer look)

While no two crises are identical, and government policy responses in 2007-2008 have been far more aggressive, as compared to actions taken in the aftermath of 1929, no one can guarantee that this is the ultimate solution that will solve all our troubles. (Do Paulson & Bernanke actually have things under control!!!!)

Jesse Livermore the legendary stock market speculator once said, ‘‘ The average man doesn’t wish to be told that it is a bull market or a bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing.’’

While I’m not saying that we are headed for another great depression, the question I’m trying to address is – ‘What’s an investor to do now?’

For example, if the Dow Jones Industrial Average(DJIA) were to come down to a level of 7000 ( Yesterday's close: 8419.09), it would imply a further drop of almost 17%.

The DJIA at 7000 would mean a crash of almost 50.58 % from the record highs.

Impossible? Here’s an analysis.

While no two crises are identical, and government policy responses in 2007-2008 have been far more aggressive, as compared to actions taken in the aftermath of 1929, no one can guarantee that this is the ultimate solution that will solve all our troubles. (Do Paulson & Bernanke actually have things under control!!!!)

Jesse Livermore the legendary stock market speculator once said, ‘‘ The average man doesn’t wish to be told that it is a bull market or a bear market. What he desires is to be told specifically which particular stock to buy or sell. He wants to get something for nothing.’’

While I’m not saying that we are headed for another great depression, the question I’m trying to address is – ‘What’s an investor to do now?’

For example, if the Dow Jones Industrial Average(DJIA) were to come down to a level of 7000 ( Yesterday's close: 8419.09), it would imply a further drop of almost 17%.

The DJIA at 7000 would mean a crash of almost 50.58 % from the record highs.

Impossible? Here’s an analysis.

In the initial fall of the 1929 Crash, the DJIA witnessed a similar vertical drop. The current crash in the DJIA occurred over a longer time frame, with the all time high being 14,164.53 on 9th October 2007. It must be noted however, that the DJIA was trading at around the 13,000 levels as recently as May 2008.

As an investor or a speculator, would you play for a bounce or a sustainable long term recovery now? Fundamental news continues to deteriorate, take for example the fall in auto sales announced yesterday, or Bernanke’s comments that further rate cuts (without more bailouts) may not be enough to save the day!!

Should a long term investor buy in now or wait?

It’s important to consider the possibility of things really taking a turn for the worse.

I mean, some people who bought stocks in 1932 actually made money in a depression, as compared to those who bought in November 1929.

Do you sell out now?

For those that are stuck with stocks bought at much higher prices- Analyse your reasons for buying the stock in the first place. Has there been a significant deterioration in the company's business or industry fundamentals. Is the company struggling to raise debt or meet interest payments?

As an investor or a speculator, would you play for a bounce or a sustainable long term recovery now? Fundamental news continues to deteriorate, take for example the fall in auto sales announced yesterday, or Bernanke’s comments that further rate cuts (without more bailouts) may not be enough to save the day!!

Should a long term investor buy in now or wait?

It’s important to consider the possibility of things really taking a turn for the worse.

I mean, some people who bought stocks in 1932 actually made money in a depression, as compared to those who bought in November 1929.

Do you sell out now?

For those that are stuck with stocks bought at much higher prices- Analyse your reasons for buying the stock in the first place. Has there been a significant deterioration in the company's business or industry fundamentals. Is the company struggling to raise debt or meet interest payments?

Lastly, do you sell out now, or wait for the illusive bounce which could be on the cards?

The answer to these questions will depend on your individual risk profile, investment/trading time horizons and ability to survive the ongoing financial storm. Yes even good businesses and companies with stong cash flows and fundamentals will see their stock prices crash in such a meltdown. Decisions must be taken by considering the adequate margins of safety you need, and the maximum losses that you are willing to take if the situation continues to deteriorate.

The answer to these questions will depend on your individual risk profile, investment/trading time horizons and ability to survive the ongoing financial storm. Yes even good businesses and companies with stong cash flows and fundamentals will see their stock prices crash in such a meltdown. Decisions must be taken by considering the adequate margins of safety you need, and the maximum losses that you are willing to take if the situation continues to deteriorate.

REMEMBER : Your LIQUIDITY position will determine your success or failure rate.

You must be able to buy, when everyone is forced to sell-----(Yes easier said than done, considering its impossible to ever call a bottom for any market).This has been the hallmark of all the great investors, traders and speculators, be they Warren Buffett, Jim Rogers, Marc Faber or George Soros.

Here’s what I’m doing now.

In my personal portfolio in India, I continue to hold on to core long term holdings. For the record,I have never held Real Estate stocks or stocks of Brokerage firms, whose values in my opinion may never ever reach their all time highs, much like the Nasdaq post 2000. I do believe that the broader market and certain stocks in particular, appear to be oversold here, so I am not a seller at these lows.

I am compiling a list of stocks I would like to buy, and am also considering investing in Index funds to play this oversold situation, for a bounce.

But as always, I will continue to add to gold positions on declines, and will use any significant stock market declines that trigger margin calls and cause selling in gold, to do so.

Lastly, as my disclaimer says 'Investors must carry out their own research & make their own informed investment decisions, using qualified independent advice. Always invest with an adequate margin of safety and know your own investment risk profile. Neither the information nor any opinion expressed constitutes a solicitation to buy or sell any securities nor investments.'

No comments:

Post a Comment