The Fed cannot afford another rate cut (remember the Strong USD campaign), but any rate hike to fight inflation will trigger further sell offs in the already jittery equity markets.

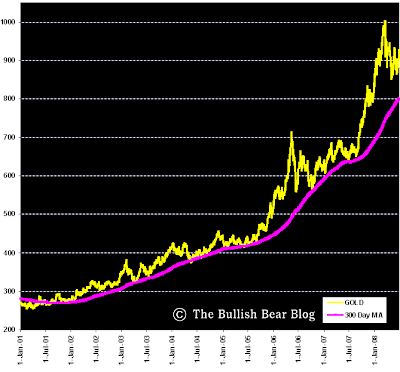

As you can see, the 300 day MA has been a very consistent and reliable support for Gold since early 2001.

( The Chart below was compiled with data from my friend Stamatis Leontsinis!)

How LOW can Gold go???

How LOW can Gold go???Looking to GOLD's 300 day MA , I do not expect any downside below the the $800-$825 levels. I would buy Gold on days when it declines significantly, like the recent decline a week ago when it fell by over $20 in a single session.

The 300 day MA is at the $800 level currently. Over the next couple of months, volatility in Crude oil prices and any pullbacks in the Euro will lead to increased volatility in Gold. Use the declines to buy!

Remember, Gold loves stagflationary environments: Slowing Growth & rising Inflation.

High oil prices and High food prices are contributing to rapid inflation the world over

US Housing, US Financials and the US Auto sector have really struggled in the first half of 2008. These sectors are going to contribute to deteriorating employment numbers in the second half.

In the mean time I will add to Gold positions on declines.

No comments:

Post a Comment