Tuesday, April 28, 2009

ARE WE THERE YET ? : Main Street vs. Wall Street

Shipping Slowdown: The ‘Baltic Freight Index’ reflects the current state of slowdown in world trade. As an industry executive said ‘Too many ships chasing too little cargo’.

The Suez Canal Authority and the Panama Canal Authority are renegotiating and thinking of reducing passage fees.

Auto Industry: Just like the real estate sector, the auto industry expanded rapidly on the surge of easy credit over the last few years. The sector is now facing a situation of massive inventory levels and sluggish sales. Unemployment figures will rise, if auto giants like GM and Chrysler file for bankruptcy.

Consumer Consumption: The end of the road for Goldilocks:

Faced with job losses, home foreclosures and banks that are unwilling to lend, individuals are cutting back on expenditure.

Instead, they are resorting to paying back debt and saving a bit more.

Here are the results of my ‘Consumer Stress Test’

Hotel Occupancy remains low, and room rates are expected to fall still further. ‘Mega’ hotel plans in Asia by large hotel groups are being shelved!!

Airlines too are complaining of the continued fall in passenger traffic.

Student Loans – are getting hard to come by, and graduates are struggling to find jobs in an ‘impossible’ job market. If 'parents' lose their jobs, students will need to take on more debt, but I expect further tightening in lending to students!

Credit Cards – Credit Card debt is getting more expensive. Even creditworthy borrowers are having a hard time. Credit Card related losses will be the next big source of write downs at the banks.

Retail Sales are struggling. As consumers are cutting back on brands and luxury items, retailers are cutting back on new store launches.

Media – Television and newspaper firms are faced with declining advertising revenues.

Companies are cutting back on ad spends as advertising budgets are being rationalized.

Apparently consumers are even cutting back on satellite TV subscription budgets

Lastly, US Bankruptcy filings are still increasing!

Unemployment: Government announced figures could be understated!

The continuing credit crisis has resulted in job losses across sectors.

If GM or Chrysler file for bankruptcy – unemployment numbers will surge.

Commercial Real Estate: We’ve all heard a lot about the collapse in home prices. As jobs are lost and vacancies arise in office space and retail malls, this sector could face quite a challenging time. Most REITS are highly leveraged and they will struggle to refinance loans and raise further equity. These REITS purchased these properties at high valuations (backed up with easy credit), and are now struggling service their debt as vacancies at their properties are on the rise.

Banking Sector: Surprise! Surprise! The US Banking sector is profitable again, albeit artificially supported by the FED, AIG handouts and proprietary trading activity. Let’s hope they are not underestimating risks taken on their proprietary trading books. It’s a crisis of solvency and not of liquidity, but I expect they will pass their stress tests with flying colours!

Pension Funds and Savers: These have been badly affected by the actions of the FED and the collapse in prices across asset classes.

Imagine a pension fund losing 30% or more over the last year, because the fund invested in private equity funds and hedge funds; that were not as ‘safe and liquid’ as first estimated.

Or the Saver who now gets nothing on his bank deposits/ CDs because the FED is trying to save ‘big business’

A short while ago, I wrote of the losses at University Endowment funds and University retirement funds. Funding and grants for research programmes will also be affected.

Until recently, student tuition fees at US universities have been rising rapidly; a trend that may not continue. Massive falls in endowment fund values combined with declining income will hurt spending activities at universities.

Work VISAs and Student VISAs:

Given the state of the US job market, campus hiring is suffering badly.

Even US work VISA applications by the Indian IT sector have failed to match the incredible demand of previous years. The IT sector is not hiring agressively anymore.

Well known educational institutes in India such as the IITs and the IIMs have noticed a marked drop in campus recruitments by Investment Banks and Multinationals.

(One positive upside from all this is that large Indian firms will be able to hire excellent talent at attractive rates, whereas up until a few years ago, they were being outbid by foreign banks and MNCs.)

Business Outlook of Non Banking CEOs - It’s a classic ‘ Emperor’s new clothes’ story! Only the Banking CEOs claim to see an improvement!!!

Manufacturing sector CEOs are still cutting back on capex plans, trimming workforces and cutting inventory levels.

Banking Ceos are so eager to get back to the heady days of mega bonuses and irrational risk taking, that they are only too ready to claim that things are back to normal again.

The ‘Let them eat cake’ attitude: In a recent post, Jim Kunstler (Clusterfuck Nation by Jim Kunstler) wrote of the possibility of rising inequality and the possibility of a breakdown in law and order.

It’s important to remember that most blue collar workers didn’t get a share of the massive profits and bonuses enjoyed by the upper management and equity shareholders over the past few years. Now they are being forced to share the losses of a system they did not control or understand. Governments may soon be battling both a financial crisis and a ‘law and order crisis’ if things really get out of hand!

To conclude,

Wall Street is far more optimistic than Main Street.

The main drivers needed for a sustainable economic recovery at this stage are ‘earnings’ and ‘employment’, but I’m seeing no improvement just yet. As the process of deleveraging continues, many 'marginal' players will fail and many more jobs will be lost.

I’m not a permabear, but I don’t want to pay the penalty of jumping in too early. While we may have made a medium term bottom, for now it may be wiser to wait for things to clear before jumping back in.

Saturday, April 25, 2009

ARE WE THERE YET ?

I decided to set aside this alphabet soup, and just look for any 'real' signs of a sustainable economic recovery.

It's great to be optimistic, but it sometimes pays better to be realistic! Being too early (even you are right in the end) can sometimes prove to be a costly mistake.

I looked for 'green shoots' in Shipping, the Auto industry, Sports sponsorship, Chinese electricity consumption and US commercial real estate. Haven't found any yet!!!

Here are some links:

Nautical squatters to be a common sight soon

Shippers Taking It Slow in Bad Times - WSJ.com

Power consumption down 4% in first quarter -- china.org.cn

Companies drop sports sponsorships - UPI.com

UNSOLD CARS AROUND THE WORLD

UPDATED: ON THE BRINK: 15 Real Estate Firms Going, Going ...

Rats Feed Off UK Recession as Trash Mounts, Buildings Empty

I am currently working on an 'Are we there yet? : Part 2' post.

Should put it up by Monday.

Friday, April 24, 2009

CHINA BUYING GOLD ??

.

.Gold Rises to 3-Week High in London as China Increases Reserves

Doubling of China gold reserves

'''China has added to its gold reserves and now holds 1,054 metric tons of the yellow metal, according to a Friday report by the Xinhua News Agency, which cited comment by Hu Xiaolian, head of the State Administration of Foreign Exchange. ''''

China is shifting away from GSE debt to US Treasury debt (and that too -- US Treasuries of shorter term maturities). Also, China is stocking up on Hard Assets ( stakes in mining assets and mining companies) around the world.

Meanwhile the FED continues to buy long term US Treasuries, in order to keep the cost of borrowing low ( a tactic that I do not believe is sustainable in the long run).

The Chinese are thinking long term, while most western governments are focussed on short term fire fighting!

China's Sovereign Wealth Fund investments in Blackstone and the investment banks have taught them to look past the 'smoke and mirrors' analysis of bankers and focus on a sustainable long term investment plan.

Monday, April 20, 2009

COPPER - Recovery in sight ? ?

Source: www.lme.co.uk/copper.asp

The fundamental outlook remains weak, given the downturn in housing and industrial sectors.

As existing momentum of ongoing projects slows, rising inventories could result in downward pressure on copper prices.

It's important to remember that although prices have corrected sharply from their 2008 highs, they have still risen substantially since early 2003!!!

Industrial commodities (read: base metals and steel) could face strong headwinds in the second half of 2008 as companies in this sector struggle with debt servicing and weak product prices as their customers in vital industries like housing and autos face slowdowns of their own.

Can Chinese copper buying continue, given rapidly slowing consumer consumption numbers in their export markets (US and Europe)?

We're not out of the woods yet!!

Saturday, April 18, 2009

US UNEMPLOYMENT - MARCH 2009.

Friday, April 17, 2009

TRACKING BEAR MARKETS

I've heard that markets bottom 6-9 months before an economic recovery. Thing is, going into 2007-08, the markets had no clue of the 'financial tsunami' that was around the corner; so much for the efficiency of markets.

I've heard that markets bottom 6-9 months before an economic recovery. Thing is, going into 2007-08, the markets had no clue of the 'financial tsunami' that was around the corner; so much for the efficiency of markets.

Main street continues to struggle with debt, consumer consumption is weak, corporate profitability is set to drop still further and the banks could have more bad news on the way.

As Nouriel Roubini recently pointed out

Thursday, April 16, 2009

Black Swan author : Nassim Nicholas Taleb

Ten principles for a Black Swan-proof world

--By Nassim Nicholas Taleb

http://www.ft.com/cms/s/0/5d5aa24e-23a4-11de-996a-00144feabdc0.html

Wednesday, April 15, 2009

GOLDMAN SACHS & THE FINANCIAL MEDIA

Instead of clarifying the change to a December ending accounting year (previously November ending), the media went overboard proclaiming how Goldman Sachs had blown away estimates.

To be fair to Goldman Sachs, their Q1 press release clearly shows a separate account for the ‘missing month’ of 2009 on page 10. This fact was jut totally ignored in the financial media!!

Q1 press release: http://www2.goldmansachs.com/our-firm/press/press-releases/current/pdfs/2009-q1-earnings.pdf

I’ve highlighted some relevant parts from the Q1 Press Release below:

Strangely enough, the media doesn’t seem to be interested in delving further into the ‘large’ compensation and benefits section in the Q1 results.

Strangely enough, the media doesn’t seem to be interested in delving further into the ‘large’ compensation and benefits section in the Q1 results.Adjusted for the month of December 2008, the results may not have been that spectacular.

Also the Goldman Sachs management doesn’t seem to want to discuss the AIG payout issue!!

Lastly, I hope that the Goldman results weren’t the result of ‘dangerous or uncalculated risk taking’.

We all know where that got us in 2008!

Relevant Links:

Goldman Sachs Buries Losses to Beat the ...

Goldman CFO Doesn't Get The Obsession With AIG

So What's the Story Morning Glory?

How to Puff Up Earnings, Goldman Sachs Style

Is Goldman Sachs really this stupid?

Tuesday, April 14, 2009

THE MARGINAL PRODUCTIVITY OF DEBT

And then the party ended! With falling incomes (job losses etc) and crashing profitability, how exactly are these debts going to be serviced?

While researching this topic I came across the concept of ‘The Marginal Productivity of debt’

Here is an excerpt from a recent article by Professor Antal E. Fekete. http://www.professorfekete.com/

Its really incredible how the Financial Media and government really ignores anyone who is opposed to taking on unsustainably high levels of debt.

http://www.gold-eagle.com/gold_digest_08/fekete041309.html

"""""The concept of marginal productivity of debt is curiously missing from the vocabulary of mainstream economists. They are watching the wrong ratio, that of the GDP to total debt, and take comfort in the thought that by that indicator 'there is lots more room' to pile on more debt. As a consequence, the marginal productivity of debt went into further decline. This was a danger sign showing that additional debt had no economic justification. The volume of debt was rising faster than national income, and capital supporting production was eroding fast. If, as in the worst-case scenario, the ratio fell into negative territory, the message would be that the economy was on a collision course with the iceberg of total debt and crash was imminent. Not only does more debt add nothing to the GDP, in fact, it necessarily causes economic contraction, including greater unemployment. Immediate action is absolutely necessary to avoid collision that would make the 'unsinkable' economy sink.

Negative marginal productivity

Why is a negative marginal productivity of debt a sign of an imminent economic catastrophe? Because it indicates that any further increase in indebtedness would inevitably cause further economic contraction. Capital is gone; production is no longer supported by the prerequisite quantity and quality of tools and equipment. The economy is literally devouring itself through debt. The earlier message, that unbridled breeding of debt through the serial cutting of the rate of interest to zero was destroying society's capital, has been ignored. The budding financial crisis was explained away through ad hoc reasoning, such as blaming it on loose credit standards, subprime mortgages, and the like. Nothing was done to stop the real cause of the disaster, the fast-breeder of debt. On the contrary, debt-breeding was further accelerated through bailouts and stimulus packages.

In view of the fact that the marginal productivity of debt is now negative, we can see that the damage-control measures of the Obama administration which are financed through creating unprecedented amounts of new debt, are counter-productive. Nay, they are the direct cause of further economic contraction of an already prostrate economy, including unemployment.”””""

A lot of leveraged players are going to struggle to service their debts.

Real Estate Moguls, Casion Moguls, Car Companies, Home Builders, Failed LBO deals, indebted and now jobless home owners and creditcard holders, Governments in Eastern Europe needing bailouts etc etc.

Even if none of the above wants to go into default --- just how are they going to service their debts ?

In many cases the current market price of an asset previously acquired is so far below its price of purchase - that it may make more sense to default! ( Think overvalued property deals and underwater home and commercial real estate mortgages)

As Professor Fekete says, focus on the marginal productivity of debt and not just GDP to total debt.

While we may be all set for a deflationary collapse, the only way out may be to trigger a tidal wave of massive inflation.

WATCH THIS SPACE!

Tuesday, April 7, 2009

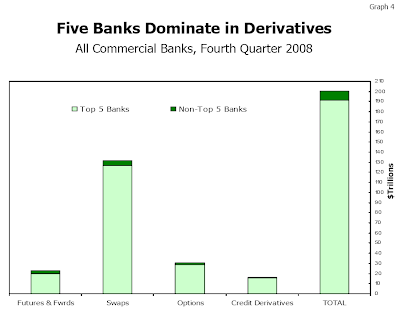

DERIVATIVES ---- IT'S NOT OVER YET !

Kind of puts the G-20 -> IMF's $1Trillion package into perspective. The proposed IMF gold sale of approximately $12Bn is just a drop in the ocean.

No wonder these guys are all for suspending MTM rules or avoiding marking anything to market ( if the market really does exist!)