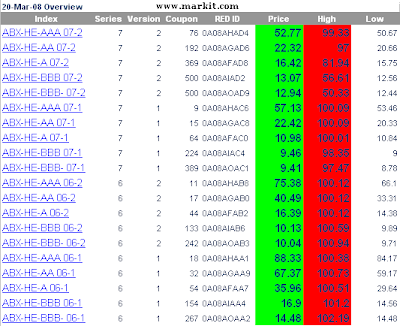

'The ABX Index is a series of credit-default swaps based on 20 bonds that consist of subprime mortgages.ABX contracts are commonly used by investors to speculate on or to hedge against the risk that the underling mortgage securities are not repaid as expected.' www.markit.com

My November 10, 2007 Post : http://thebullishbear.blogspot.com/2007/11/subprime-mortgages-abx-indices.html

THEN

NOW

TO DO LIST :

Bail out the Investment banks, Banks with lax lending standards, speculators and CDO people that got us here in the first place.

Central Banks to buy all Toxic mortgage backed securities from banks & end the Credit Crisis.

Bail out the AAA rated Bond Insurers.

Bail out the US Housing market.

Bail out Freddie Mac and Fannie Mae, or nationalise them if need be.

Save the US DOLLAR.

Save the US CONSUMER.

REAL ESTATE FIRMS:

REAL ESTATE FIRMS:

Wheat:

Wheat: Soybean:

Soybean: