Cheap money has resulted in

- Inflated asset prices,

- Rising raw material prices(oil, base metals, metal ores, and coal)

- An extreme out performance across emerging markets,

- Overleveraged and overvalued LBO deals

- Rising home prices in the US coupled with refinancing of home mortgages at lower rates, enabling the US consumer to spend his way out of a recession post 9/11.

- An exponential expansion in mortgage backed derivatives fuelled by a once booming US housing market.

Here's what happened>>>

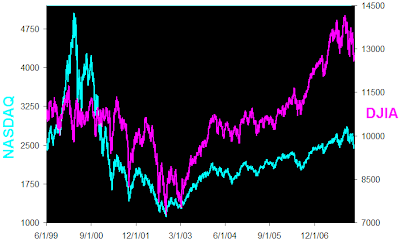

Fed Rates hit a 45 year low of 1% in 2003.  The US Stock Market rallied, as the Goldilocks economy(moderate economic growth : not too hot or cold & low inflation, ) continued on its way.

The US Stock Market rallied, as the Goldilocks economy(moderate economic growth : not too hot or cold & low inflation, ) continued on its way.

High debt levels, falling US home prices, and rising interest rates have resulted in a mega catastrophe. US Consumer Confidence is low and as the economy continues to slow, the US consumer will cut back on spending. Huge cash infusions by Central Banks and bailouts by Arab and Asian investors have been unavoidable as leading investment banks are struggling to meet regulatory capital adequacy requirements. The mess in the derivative markets continues, with concerns over losses in Credit-default swaps, and many mortgage backed derivative securities now being seen as toxic WMDs.

Uncontrolled credit expansion encourages reckless consumption and excessive leverage. When the prices of leveraged & overvalued assets start to unwind, the consequences are disastrous.

So are we heading for a "Stagflationary" Bear Market in the US?

Slow economic growth, Inflation and relatively high unemployment = Stagflation

Gold has always done well in such periods, when Central Banks are unable to raise rates to combat inflation due to slowing growth.

Meanwhile, economies such as India and China are consuming increasing quantities of oil, raw materials and food grains as the standard of living across the region continues to rise. Due to their low cost advantage, Asian economies are emerging as manufacturing centres of the world, as production activities continue to shift to developing economies.

No comments:

Post a Comment