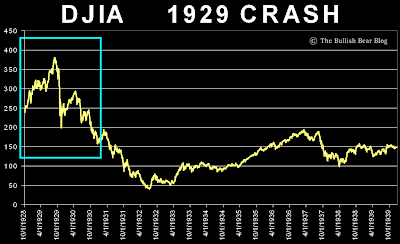

When you look at a chart that has witnessed an almost vertical drop, you know that its worth a second look!!!!! As the CRB Commodity Index shows, gains accumulated over the last 3 years were wiped out in 4 months!!This deleveraging commodity meltdown has been much faster than most expected, as speculators and leveraged hedge funds have bailed on this once '''must have sector'''. Now that the'weak hands' have been forced out, commodities look interesting again!!!

Welcome to Commodities round 2!

While I am not a big fan of Base metals/metal ores, even these commodities have seen a sharp selloff! Given the global slowdown and recession we are in, industrial metals and ores could take a while to recover.

GOLD - meanwhile has held its own amidst all the turmoil in the credit markets, stock market and in the real economy. I repeat that Gold IS NOT A METAL, but a currency that is a true store of value.

It is one of the most liquid mediums of exchange; something that many high networth individuals who are trapped in ILLIQUID HEDGE FUNDS may now realise!I continue to be quite optimistic on

soft commodities, such as corn, wheat, soybean and other agriculturals, which continue to see growing demand in emerging markets along with the alarming possibilites of reduced acerage and farmer bankruptcies on the back of the recent food grain price collapse.

I have never been a supporter of using 'food for fuel', but irrespective of the meltdown in the ethanol industry, these food crops look interesting at this stage.

Coming to

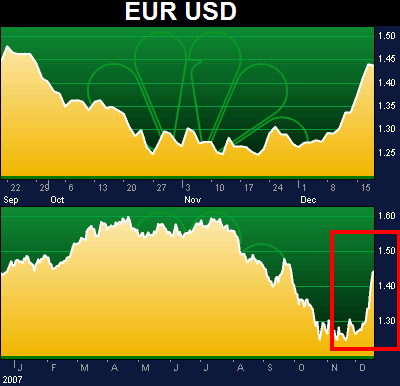

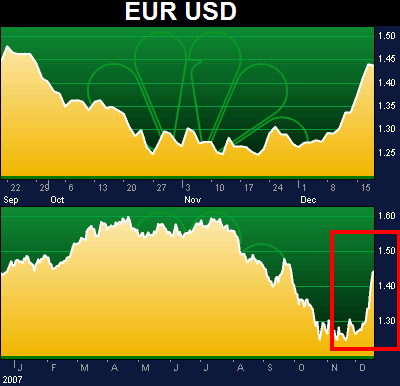

Crude Oil, although the selloff has been sharp, in the near term a demand slowdown can cap any attempts of a rally here. However you must remember that the recent strength in the USD has been showing some sings of weakening lately, and any USD currency volatility / crisis in 2009 will support crude oil prices even if demand fails to recover.

Longer term I remain an oil bull, given the lack of fresh capacities added, as also growing consumption in Asian economies.

Will post more on Crude Oil and Soft Commodities in coming weeks.

Will post more on Crude Oil and Soft Commodities in coming weeks.