Not in a long while have I seen so many Financial Market Analysts absolutely puzzled by the current state of markets. Incredible intraday volatility and a total loss of confidence have resulted in a very lackluster dead cat bounce and then continued unrelenting selling.

With due respect to Warren Buffett and some other cash rich value investors who recently came up with ‘BUY’ calls; these are dangerous times in the investing world. Even prior to this crash, most investors were either fully invested or overexposed to equities. Many investors especially those nearing retirement may now realize that large exposures to the equity markets was a grave mistake!

TO BUY OR NOT TO BUY?

While I would say that there has been a panic led forced selling across world markets (including gold bullion), many stocks are now trading at attractive valuations. I would think that we will see more downside before an uptrend emerges.

Firstly, forced liquidations and realignment of risk profiles could intensify the sell off.

Secondly there is currently a great threat to the earnings growth momentum ( albeit propelled by cheap money) that the world has seen over the last 5 years. If earnings begin to stumble, cheap stocks could get cheaper.

I have been a Bullish Bear for over a year now, and although I have been conservative in my investment decisions and cautiously adding to gold positions on declines, the current crash has been incredible. I clearly wasn’t bearish enough.

GOLD & the USD

Gold has tanked over the last week on forced liquidations, margin calls and panic selling as gold was sold to raise cash. After finding support near $680, it has stabilized at $734.30.

I continue to maintain my stance on adding to gold positions on declines, buying in stages as the sell off intensifies. The rate, at which EVERYONE is being bailed out, clearly indicates that we are headed straight into a financial hurricane! AC-DC said it best; we are on the highway to hell!

Coming to the USD, as the global sell off intensifies, investors pile into the USD, and the currency has appreciated against almost all currencies excluding the Japanese Yen (which is rallying due to the unwinding carry trade).

The Litmus test of the current USD strength will occur in January next year, when USD Holders must ask themselves if they are actually safe in the currency of a ‘bankrupt nation’ whose Asian creditors are perplexed and now annoyed by the chaotic manner in which the US Leadership has let their ship run aground.

ACTIONS & CONSEQUENCES

- The US is dealing with a toxic combination of record high debt, rising unemployment and rapidly slowing growth.

- Can you really have a recovery not led by savings and investment?

- Is it not weird that the FED is asking banks to lend aggressively (even as asset prices are collapsing) to people who are already way too indebted? Weird or just crazy?

- Can the FED keep buying toxic assets at their face value – given that no one in the private sector is willing to step up to the plate. How come the Sovereign Wealth Funds are not value buying even after this crash? Do they know of coming government actions that we are not aware of?

- The fallout from the Financial and Real Estate Sectors is spreading like a cancer to the broader economy. Bailouts and rescues for Auto Loans and Credit Card loans will be next on the agenda. Basically guarantee and back stop all liabilities and defaults, so that we can get back to normal.

- Bailout after bailout; the inflationary impact (albeit with a 6-12 month time lag) of all the money supply growth currently occurring will be disastrous.

More updates on specific markets in coming posts.

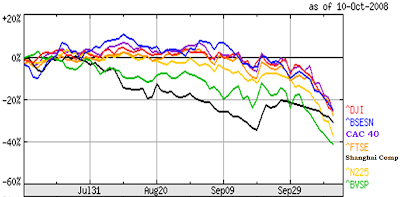

The Nikkei 225 has really tanked!!!!

The Nikkei 225 has really tanked!!!!