Thursday, January 24, 2008

Wednesday, January 23, 2008

THE CRASH : CHARTS

DOW JONES INDUSTRIAL AVERAGE : ^DJI

Nikkei 225 : ^N225

BSE SENSEX : ^BSESN

Hang Seng (Hong Kong) : ^HSI

THE LAST 5 DAYS

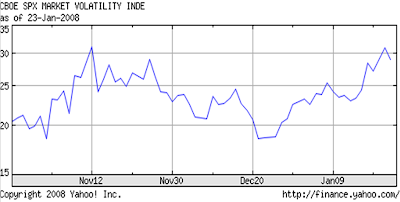

THE LAST 3 MONTHS

EUROPEAN MARKETS ALSO CONTINUE TO STRUGGLE

THE LAST 5 DAYS

CAC 40 : ^FCHI

FTSE 100 : ^FTSE

DAX : ^GDAXI

THE LAST 3 MONTHS

THE CRASH

I bought into Reliance Petroleum, Asahi Glass, Reliance Communications and yes added a little Concor.

I will put up a report on Asahi India Safety Glass; a company I believe has excellent long term potential.

Asahi Glass reported a loss for the third quarter, as a result of amortization and interest costs. With its new plants now complete and in various stages of commissioning, its future prospects are bright, as the company is now the largest integrated glass manufacturer in India. I will continue to buy it on declines.

My other Long term investment Concor held on surprisingly well, as the rest of the market collapsed. It reports results by the end of the month, and as the company is cutting prices to take on the competition, margins could be under pressure.

Longer term tie ups with Reliance logistics, Bharti -Walmart, the Transport Corporation of India etc stand it in good stead. Also its stakes in Ports and container terminals are additional positives for the stock

Its competitors in the private sector are struggling with large borrowings and increased capital expenditure charges.

I will buy some more Concor after the results.

I had not made many purchases over the last few months, except for Elecon Engineering, Sanghvi Movers and Concor, which have somewhat survived the bloodbath.

As I said before, the overvaluation in Indian Equities needed to be corrected and overvalued sectors like Real Estate, Brokerage Firms, the Power sector, and many momentum counters were really beaten down.

Always invest with an adequate margin of safety and do so according to your own investment risk profile.

Do read my blog post Smoke and Mirrors (31 / 12 / 2007). It talks about my outlook for 2008. Also do take a look at my blog post on Investing in Gold.

I see more downside for the US Markets, and Asia as the US goes into recession.

The 0.75 % rate cut will really hurt the US Dollar. Currencies that are USD pegged are going to have a hard time dealing with inflation in their local economies. This should be positive for GOLD. In the near term the continued sell off could hurt gold prices.

Will put up another update soon.

Friday, January 18, 2008

REALITY SETS IN : The downtrend resumes..

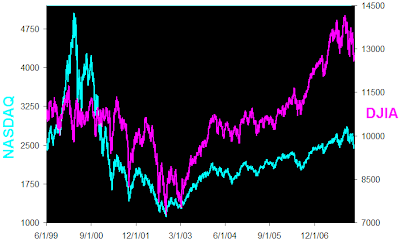

The US Stock Markets have had a rough start to 2008, and the FED seems helpless and unable to avert a severe slowdown. Small Cap companies are especially vulnerable due to their dependence on the US economy, as compared to Large multinationals that have a greater exposure to international markets.

Consumer Confidence is low.

Philadelphia FED DATA: The Diffusion Index of Current Activity.

Manufacturing in the Philadelphia region slowed significantly. The Index fell to a negative 20.9 in January, its lowest level since October 2001. Taken from the Philadelphia FED's Survey, it is considered to be the broadest measure of manufacturing conditions. http://www.philadelphiafed.org/

BOND INSURERS IN REAL TROUBLE

Bond insurers risk losing their AAA rating, as they struggle to raise fresh capital.

Clearly not the right time to be buying stocks just yet. I expect gold prices to be volatile ahead of the rate cut, with some further downside likely if a world market sell off occurs.

GOLD will outperform, as overvalued markets correct this year.

Tuesday, January 15, 2008

The Goldilocks Economy : Return of the Bears

Cheap money has resulted in

- Inflated asset prices,

- Rising raw material prices(oil, base metals, metal ores, and coal)

- An extreme out performance across emerging markets,

- Overleveraged and overvalued LBO deals

- Rising home prices in the US coupled with refinancing of home mortgages at lower rates, enabling the US consumer to spend his way out of a recession post 9/11.

- An exponential expansion in mortgage backed derivatives fuelled by a once booming US housing market.

Here's what happened>>>

Fed Rates hit a 45 year low of 1% in 2003.  The US Stock Market rallied, as the Goldilocks economy(moderate economic growth : not too hot or cold & low inflation, ) continued on its way.

The US Stock Market rallied, as the Goldilocks economy(moderate economic growth : not too hot or cold & low inflation, ) continued on its way.

High debt levels, falling US home prices, and rising interest rates have resulted in a mega catastrophe. US Consumer Confidence is low and as the economy continues to slow, the US consumer will cut back on spending. Huge cash infusions by Central Banks and bailouts by Arab and Asian investors have been unavoidable as leading investment banks are struggling to meet regulatory capital adequacy requirements. The mess in the derivative markets continues, with concerns over losses in Credit-default swaps, and many mortgage backed derivative securities now being seen as toxic WMDs.

Uncontrolled credit expansion encourages reckless consumption and excessive leverage. When the prices of leveraged & overvalued assets start to unwind, the consequences are disastrous.

So are we heading for a "Stagflationary" Bear Market in the US?

Slow economic growth, Inflation and relatively high unemployment = Stagflation

Gold has always done well in such periods, when Central Banks are unable to raise rates to combat inflation due to slowing growth.

Meanwhile, economies such as India and China are consuming increasing quantities of oil, raw materials and food grains as the standard of living across the region continues to rise. Due to their low cost advantage, Asian economies are emerging as manufacturing centres of the world, as production activities continue to shift to developing economies.

Monday, January 14, 2008

The Bullish Bear on REUTERS ! !

Here are the Links :

http://www.reuters.com/article/blogBurst/investing?type=hotStocksNews&w1=B7ovpm21IaDoL40ZFnNfGe&w2=B7pJeHult9GszE37UXlSpmUm&src=blogBurst_investingNews&bbPostId=Cz6oZBKat1SiPCzCCiaoTiqh6vBB9orR4tFaYuB51ZqKndcCXt&bbParentWidgetId=B7gSUbux1hpbz8uOa7TWsLnV

http://www.reuters.com/article/blogBurst/investing?bbPostId=Cz6oZBKat1SiPCzCCiaoTiqh6vBD6J6UuNbgMUCz9LhOt7RnVMC

http://www.reuters.com/article/blogBurst/investing?bbPostId=Cz6oZBKat1SiPCzCCiaoTiqh6vCzBI1xV3Pgj1MBEAYpBRABEO8

http://www.reuters.com/article/blogBurst/investing?bbPostId=Cz6oZBKat1SiPCzCCiaoTiqh6vCzEeSknsLIbVKCz8d7NOQ0SuGJ

Tuesday, January 8, 2008

US FED Chairman : THEN AND NOW

Here is an excerpt from the statement of the US Fed Chairman at the Federal Reserve Bank of Chicago’s 43rd Annual Conference on Bank Structure and Competition, Chicago, Illinois; on May 17, 2007

“All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even subprime mortgages, continue to perform well. Past gains in house prices have left most homeowners with significant amounts of home equity, and growth in jobs and incomes should help keep the financial obligations of most households manageable.”

January 8, 2008:

And now-----Rising Inflation, Rising Unemployment, a Falling USD, Rising GOLD & OIL Prices, Falling US home prices, Falling Consumer Confidence, Subprime fallout affecting financial institutions around the world, Mortgage Crisis, Large write offs at banks, Continuing Credit Crunch & crisis in CDO markets.

Wall Street is now expecting the Fed to cut rates by up to 50 Basis Points when it next meets. President Bush and Treasury Secretary Hank Paulson are meanwhile trying to reassure the world of the resilience of the US economy, promising policies to keep tax rates low and bailout packages for the housing mortgage crisis.

As the fourth quarter results of the US financial sector start to come in, the markets could be in for some turbulent times ahead.

Sunday, January 6, 2008

THE GOLD/OIL RATIO

Gold-Oil Ratio = Price of Gold (per oz.) / Price of Crude Oil (per barrel)

Rising oil prices result in decreased consumption and a slow down in the economy, and negatively affect stock markets. On the other hand, in times of crisis, uncertainty and rising inflation gold is always looked to as a safe haven.

Recently, we have seen both gold and oil rally, as the US Dollar continues to decline.

So are we overdue for a pull back?

A high gold oil ratio = either gold is too expensive or oil is too cheap = SELL GOLD, BUY OIL

A low Gold Oil Ratio = either gold is too cheap or oil is too expensive = BUY GOLD, SELL OIL

Historically, the Gold Oil ratio has support between 8 and 10 barrels per ounce of gold, & spikes over 20 are shortlived.

Is the gold oil ratio going to rebound?

1) oil falls and gold rises

2) gold rises faster than oil

3) oil falls faster than gold

With all the momentum in gold prices recently; fueled by a rising unemployment rate, an increased likelyhood of a recession in the US and a falling USD, gold prices could rise still further, even though gold currently looks overbought.

The possibility of a large FED rate cut is adding to the strength in gold.

Fresh buying can be avoided, waiting for a pull back.

Oil prices are facing a psychological resistance at the $100 mark. Geopolitical concerns, supply disruptions and a falling usd are fuelling high oil prices. A break past $ 100 could propel prices still higher, while a recession in the US will be oil negative.

Friday, January 4, 2008

GOLD: Continues to rise against major currencies

Also, as Crude oil hit $100 and agricultural commodities continue to rally, commodity markets are likely to attract investor interest for fresh investment allocations in 2008.

Wednesday, January 2, 2008

2008: RISING FOOD CROP PRICES.

CORN

WHEAT

SOYBEAN

RICE

RICE